Introduction

Understanding and managing program cash flow is essential for small businesses looking to maintain financial stability and ensure long-term success. Cash flow refers to the movement of money in and out of a business, and program cash flow is a specific focus on the financials tied to a particular project or program. For small business owners, maintaining healthy cash flow is a significant part of daily operations, ensuring that bills are paid, employees are compensated, and investments are made into future growth.

This guide will explain the concept of program cash flow, how to track it, and why it matters for your small business’s financial health.

What is Program Cash Flow?

Program cash flow refers to the flow of money related to specific projects, programs, or initiatives within a business. Unlike overall business cash flow, which accounts for the entire company’s financial movement, program cash flow focuses on a particular program’s income and expenses. For small businesses, having a clear view of program cash flow is essential for managing project-based finances, especially when multiple programs run simultaneously.

Program cash flow involves the following:

-

Income: The revenue generated by the specific program.

-

Expenses: The costs associated with running the program, including labor, materials, and overhead.

-

Net Cash Flow: The difference between the program’s income and expenses.

By tracking program cash flow, small business owners can get a clear understanding of how individual projects impact the overall financial health of the business.

Why is Program Cash Flow Important for Small Businesses?

Effective management of program cash flow is critical for small businesses because it helps owners identify financial bottlenecks, anticipate cash shortages, and ensure that they have enough funds to keep operations running smoothly. Here’s why it’s so important:

1. Ensures Liquidity

Without proper tracking of program cash flow, businesses can quickly run into liquidity issues. Cash flow management ensures that you always have enough cash on hand to cover program-related expenses, even if your revenue is seasonal or delayed.

2. Helps with Financial Planning

By understanding the cash flow of different programs, business owners can better forecast future financial needs. For example, if a specific program is expected to generate substantial revenue in the next quarter, the business owner can plan for expansion or hire additional staff.

3. Improves Decision-Making

When program cash flow is tracked effectively, you can make more informed decisions. For instance, you’ll know if a particular program is profitable or if adjustments need to be made to reduce costs or increase revenues.

4. Supports Business Growth

As your business grows, more programs will be added, and each will need its own financial management. Having a handle on program cash flow allows small business owners to scale effectively, as they’ll know which programs generate the most value.

How to Manage Program Cash Flow for Small Businesses

Managing program cash flow is an ongoing process that involves careful planning, tracking, and analysis. Here are the steps you should follow to ensure effective cash flow management:

1. Set Clear Financial Goals for Each Program

Before launching any program, it’s crucial to set clear financial goals. What do you expect the program to achieve in terms of revenue and profit? Having defined financial targets for each program helps you track whether the program is on track or needs adjustments.

2. Track Cash Flow Regularly

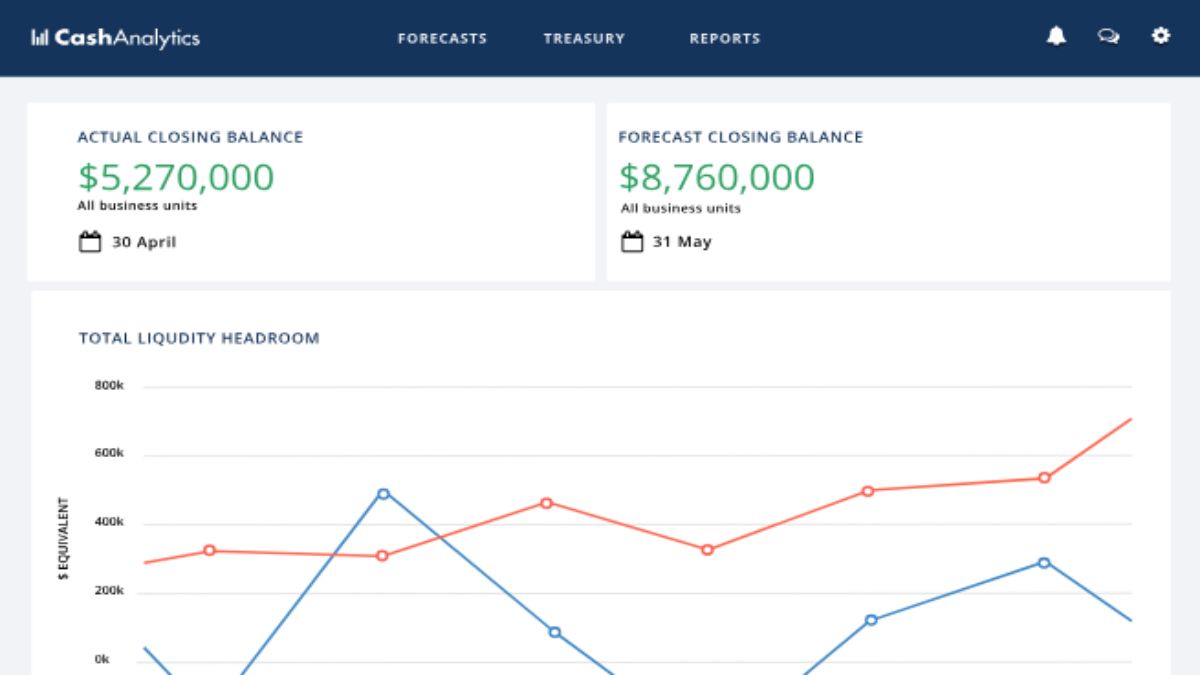

Consistency is key when it comes to tracking cash flow. Use financial software or spreadsheets to monitor both income and expenses for each program. Be diligent in updating your cash flow regularly so you can identify any discrepancies or potential cash shortages early on.

3. Use Cash Flow Forecasting

Cash flow forecasting involves estimating future inflows and outflows of cash for each program. By forecasting, you can predict potential cash flow gaps and plan accordingly. Forecasting is especially important for seasonal businesses or projects with irregular income.

4. Control Expenses

Managing expenses is one of the most effective ways to maintain a positive cash flow. Regularly review program-related expenses and look for areas where you can cut costs. Whether it’s negotiating better rates with suppliers or reducing overhead, controlling expenses will directly impact your bottom line.

5. Maintain a Cash Reserve

Having a cash reserve is essential for managing unexpected expenses or cash shortages. Setting aside a portion of the profits from each program helps ensure that you can weather any financial storms and avoid disruptions to your business operations.

Common Challenges in Managing Program Cash Flow

While program cash flow management is crucial, it’s not without its challenges. Below are some of the common issues small business owners face:

1. Delayed Payments

One of the most significant challenges small businesses face is delayed payments from clients or customers. If you’re relying on a program’s revenue to fund other activities, a delay in payments can disrupt your cash flow and cause financial strain.

2. Overestimated Revenue

Small business owners sometimes overestimate the revenue potential of a program. Without careful forecasting, you may assume that a program will generate more income than it does, leading to cash flow gaps when expenses surpass the actual income.

3. Unexpected Expenses

Program-related expenses can sometimes exceed expectations, especially if unexpected costs arise during execution. Whether it’s higher labor costs or unforeseen supply chain disruptions, these extra expenses can cause negative cash flow if not managed properly.

4. Poor Cash Flow Visibility

Without a clear view of program cash flow, business owners may not be aware of problems until they’re too late. This can lead to mismanagement, missed opportunities, and financial stress.

Conclusion

Effective management of program cash flow is a critical skill for small business owners. By understanding what it is, why it’s important, and how to manage it, you can ensure your business maintains financial stability and is positioned for growth. Implementing a strategy for tracking, forecasting, and controlling cash flow is key to success.

FAQ Section

1. What is the difference between cash flow and program cash flow?

Cash flow refers to the overall movement of money in and out of a business, while program cash flow specifically refers to the finances related to a particular project or program within the business.

2. How can I forecast program cash flow?

Forecasting involves estimating future income and expenses for your program. This can be done using financial software or spreadsheets, based on past trends and future projections.

3. Why is cash flow important for a small business?

Cash flow is essential because it ensures a business has enough liquidity to cover its day-to-day operations and avoid financial troubles. Proper management can also help a business plan for future growth.

4. How often should I review my program cash flow?

You should review your program cash flow regularly, ideally on a monthly basis, to ensure you’re staying on top of expenses and income. Regular tracking helps you spot potential issues before they become critical.

5. What tools can help me manage program cash flow?

There are several tools available, including accounting software like QuickBooks, Xero, or FreshBooks, which offer features for tracking program cash flow, forecasting, and generating financial reports.

6. What are the signs that my program cash flow is in trouble?

Some signs that your program cash flow might be in trouble include consistently missing income targets, delayed payments, or expenses regularly exceeding forecasts.